For more information on available Single NNN tenant triple net lease investments visit us and click on

What is a Triple net or NNN lease investment and a 1031 Exchange A

triple net lease (Net-Net-Net or NNN) is a lease agreement on a property where the tenant or lessee agrees to pay all of the real estate taxes, building insurance, and maintenance (the three "Nets") on the property in addition to any normal fees that are expected under the agreement (rent, utilities, etc.). In such a lease, the tenant or lessee is responsible for all costs associated with the repair and maintenance of any common area. This form of lease is most frequently used for commercial freestanding buildings. In a triple-net lease (NNN) example, the tenant pays all the operating expenses, property taxes, utilities, insurance premiums, maintenance and repairs. The landlord gets to collect monthly net rental income just as he or she would with a traditional real estate investment. Such a lease usually extends over the long term, with a financially strong corporate entity guaranteeing a lease anywhere from 10-25 years. NNN’s are typically purchased on a cap rate. A CAP rate is essentially a yield which is determined by dividing the tenant’s annual rent by the purchase price. For example, if Walgreens is paying $325,000 annually and the purchase price is $5,000,000, the CAP rate is 6.50% ($325,000/$5,000,000).

Walgreens is your tenant for a corporate guaranteed 25-year period. The tenant is responsible for all costs to operate and maintain the property, this is sometimes referred to as an “Absolute” Triple-Net lease because the only management required is paying the mortgage (if there is one) and receiving the rent checks. Triple-Net Lease ownership is great for first-time real estate investors as well as for

long time investors seeking purchase or trade into less complicated real estate investments. In many cases, when the lease expires, you will own the property free and clear.

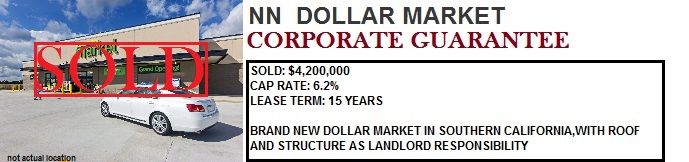

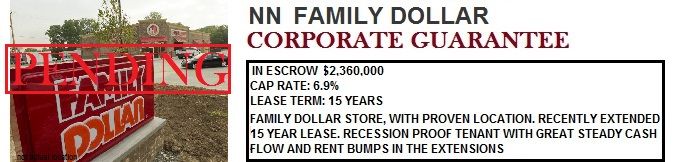

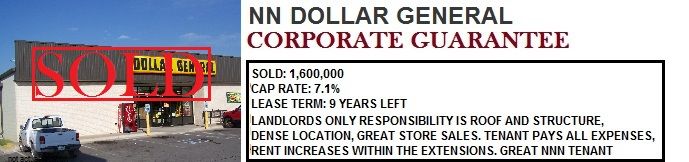

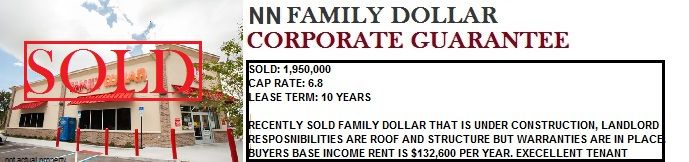

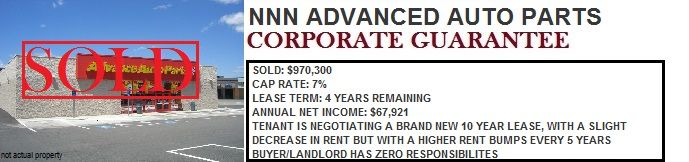

The price range for a NNN lease property is generally between $1million - $10million. The Fast Food Restaurants, Auto parts Stores, Dollar Stores, Convenience Stores/Gas Stations and Banks are the most affordable, while Drugstores are on the higher end. Big box retailers such as Home Depot, Lowe’s, and Publix can bring from $15 million to $25 million.

1031 Exchange GuidelinesThere are very specific 1031 exchange identification requirements for identifying potential like-kind replacement properties in your 1031 exchange transaction. The prospective like-kind replacement properties that you identify as part of your 1031 exchange do not need to be under contract or in escrow when you identify them.

1) REAL PROPERTY USE: Both your old and new properties must qualify as investment or business use. If both properties pass this test, you can exchange nearly any type of real estate.

2) 45 DAY IDENTIFICATION PERIOD: A seller must identify another replacement property that he proposes to buy within 45-day period from the date he sold his relinquished property. The 45-day timeline is very rigid and does not allow any variances (even if the 45th day should fall on a weekend or holiday.) Note that during this period, the proceeds from the sale of the relinquished property are in the custody of the qualified intermediary.

3) 180 DAY EXCHANGE PERIOD: An individual has 180 days from the date of selling their property that was the basis for the 1031 to receipt of the newly-acquired property. The period within which the person who has sold the relinquished property must receive the replacement property is referred to as the “Exchange Period” under 1031 of the IRC. This period ends at 180 days after the date on which the person transfers the property relinquished or the due date for the person's tax return for the taxable year in which the transfer of the relinquished property occurred, whichever is earlier. A word of caution: Many ill-advised or careless investors see the language referring to the due date for their tax return and assume they can wait until the last minute to purchase the new property. Remember – the deadline is the EARLIEST of the two scenarios. If an individual were to sell their 1031 property in May, the deadline for acquiring a new property (180 days) would fall well before their tax return in the spring of the following year.

While the utilization of 1031 exchanges can be an extremely valuable tool for maximizing tax savings, it is a very complex process and often difficult to navigate.

Identification Rules and

Exceptions

1031 EXCHANGE IDENTIFICATION RULESYou must comply with at least one of the following identification rules or exceptions when completing the identification of your like-kind replacement properties:

It's advised that you get a purchase agreement set up and are placement property in mind before starting the 1031 process. This is because "The three-property rule" (under 1031 tax exchange regulations) declares that the exchanger of a relinquished or replacement property may identify up to 3 replacement properties, regardless of their value.

THREE (3) PROPERTY IDENTIFICATION RULEThe three (3) property identification rule limits the total (aggregate) number of like-kind replacement properties that you can identify to three (3) potential like-kind replacement properties. The vast majority of Investors today use this three (3) property identification rule.

You could acquire all three of the identified like-kind replacement properties as part of your 1031 exchange, but most Investors only acquire one of the three identified properties. The second and third identified properties are merely identified as back-up like-kind replacement properties incase you can not acquire the first property.

You will skip the three (3) property identification rule and use the 200% of Fair Market Value Rule if you are trying to diversify your investment portfolio and wish to identify more than three (3) like-kind replacement properties.

200% OF FAIR MARKET VALUE IDENTIFICATION RULEYou can identify more than three 3 like-kind replacement properties as long as the total (aggregate) fair market value of all the identified like-kind replacement properties does not exceed 200% of the total (aggregate) net sales value of your relinquished properties sold in your 1031 exchange. The limitation is only on the total (aggregate) identified value. There is no limitation on the total number of like-kind replacement properties.

For example, if you sold relinquished properties in the amount of $2,000,000 you would be able to identify as many like-kind replacement properties as you want as long as the total (aggregate) value of the identified like-kind replacement properties does not exceed $4,000,000 (200% of $2,000,000).

95% IDENTIFICATION EXCEPTION

If more than three properties have been identified, and their total fair market value exceeds 200% of the value of what was sold, the exchange may still be valid if 95 % of the total cost of all properties on the list are purchased. This means if there are properties costing $100,000 on your list, then you must purchase at least $95,000 of them.

At NNN Investments we can assist you in locating a like-kind property for a 1031 exchange and ensure a smooth and successful transaction.

1031 EXCHANGE FAQ

Q: What property is like kind to my property?

A: When it comes to real estate generally, all property is like kind to all other real estate. For example, farmland can be exchanged for an office building or a condominium can be exchanged for a trailer park. The state law of the jurisdiction in which the property is located will define the definition of what is an interest in real estate, such as mineral interests, water rights, etc. Our business focuses on exchanges of real estate and exchanges of certain other tangible personal property, like airplanes, equipment, and livestock can be exchanged. Whether personal property is like kind is determined by reference to certain depreciation classifications. We can handle exchanges of real estate or personal

property.

Q: What must I do to have a fully deferred exchange?

A: The general rule is that, in order to have a fully tax deferred exchange, the exchanger must trade equal or up in equity and debt. The effect of this rule is that the exchanger must use the entire net proceeds from the relinquished property as down payment on the replacement property. Also, the exchanger must replace any mortgage paid off at the sale of the relinquished property with an equal or greater mortgage on the replacement property. Any cash received by the exchanger whether at the sale of the relinquished property or at the purchase of the replacement property will be deemed "cash boot" and tax will be recognized to the extent of gain. This rule applies regardless of the exchanger’s cash position in the relinquished property. Regardless of the size of the exchanger’s down payment, principal pay-down, or capital improvements on the relinquished property, the exchanger will be treated as having received "cash boot" if cash is received as part of the exchange. The fair market value of the relinquished property can be calculated by subtracting from the selling price the ordinary and customary

transaction costs of the sale. These transaction costs are limited to those costs directly related to the sale of the relinquished property. The most common transaction costs are brokerage fees, title insurance fees, exchange service fees, and recording fees.

Q: May I have a partially tax deferred exchange?

A: If the rule described in the answer above is violated, a partially tax deferred exchange is the likely outcome. If the exchanger trades down in either debt or equity then some gain is likely to be recognized. If the exchange portion of the transaction is otherwise valid, a partially deferred tax exchange is the result.

Q: What is boot?

A: "Boot" is anything of value received by the exchanger, which is not "like-kind" to the relinquished property.

Cash Boot - If the exchanger receives cash upon sale of the relinquished property this will be treated as "cash boot" and tax will be recognized to the extent of gain in the transaction. For example, if the QI receives $40,000 upon sale of the relinquished property and the exchanger elects

to receive $10,000 in cash at closing, the exchanger will pay tax on $10,000 while the exchange is completed with the remainder of the funds held by the QI.

Mortgage and other Boot - If the exchanger fails to purchase a replacement property of equal or greater value than the relinquished property there is a strong possibility that he will be deemed to have received "mortgage boot." For example, if the exchanger relinquishes a property valued at $100,000 and deposits $50,000 with their QI and a $50,000 mortgage is paid off, then replaces with a property valued at $90,000 with $50,000 cash down and a replacement mortgage of $40,000 the exchanger will pay tax on $10,000. This is an example of the receipt of "mortgage boot." An exchanger can also receive other property, which will be deemed boot. For example, if the exchanger receives an automobile, artwork, or any other thing of value as part of an exchange, that other non-like kind property will be deemed boot and taxed on the fair market value allocated to it.

Q: Can I refinance a property immediately prior to the exchange?

A: Recent tax authority suggests that a refinancing of the relinquished property prior to sale with receipt of cash by the exchanger may not be deemed "cash boot" under certain limited circumstances. This course of action is not generally recommended. In the event the exchanger needs cash for an independent business purpose, it is strongly recommended that the exchanger refinance the replacement property after acquisition and when the independent need for cash arises.